Unpacking the WSJ’s Legal Challenge to Trump’s Tariffs: What’s at Stake for America?

Posted in :

Challenging Presidential Tariffs: The Wall Street Journal’s Legal Warning to Trump

WSJ Calls for Legal Action on Trump Tariffs

In a bold move that has stirred intense debate in political and economic circles, the Wall Street Journal editorial board has taken aim at former President Donald Trump’s imposition of tariffs, specifically calling for legal action against what they view as an abuse of executive power. This isn’t just another op-ed; it’s a powerful statement in the ongoing conflict over who gets to shape U.S. trade policy—and how.

While tariffs may seem like a dry economic instrument, they carry massive implications not only for the global market but also for constitutional checks and balances. By highlighting possible violations of established laws, including the 1977 International Emergency Economic Powers Act (IEEPA), the WSJ raises profound questions: Where does presidential authority end? Should Congress have more say? And what does all this mean for everyday Americans navigating rising prices and unstable job markets?

The Trump Tariff Doctrine: A Strategic Disruption or Dangerous Overreach?

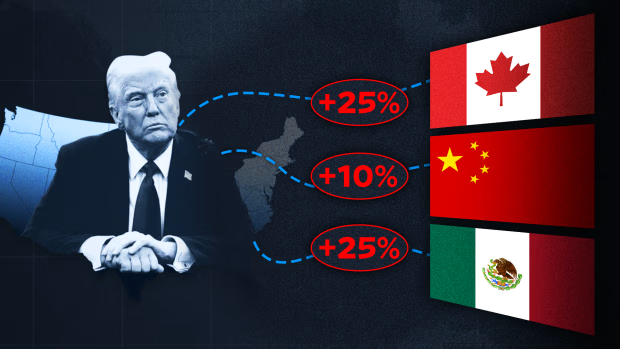

When President Trump implemented sweeping tariffs on steel and aluminum in 2018—most notably targeting Canada and Mexico—it marked a seismic shift in U.S. trade relations. Trump’s administration justified the move by citing national security concerns, invoking Section 232 of the Trade Expansion Act of 1962 and IEEPA to bypass Congressional approval.

- Tariff Details:

- 25% on imported steel

- 10% on imported aluminum

These tariffs were promoted as necessary to protect U.S. industries and reduce reliance on foreign producers. However, critics, including prominent economists and lawmakers, questioned both the economic rationale and the legal foundation of the move.

International Repercussions: Trade Wars with Friendly Neighbors

Canada and Mexico—two of America’s largest trading partners—were quick to respond. Far from accepting the tariffs passively, they countered with retaliatory tariffs that targeted emblematic American exports:

- Canada: Hit U.S. steel, aluminum, whiskey, and dairy

- EU: Retaliated with tariffs on bourbon, motorcycles, and peanut butter

This back-and-forth spiraled into what many dubbed a “trade war,” undermining diplomatic ties and creating ripple effects for U.S. exporters, farmers, and manufacturers.

“Trade wars are not won with tweets and tariffs—they are lost by the people in the grocery aisle and on the assembly line.” – International Trade Scholar

The Legal Challenge: Does the President Have Too Much Power?

The crux of the Wall Street Journal’s editorial isn’t economic—it’s constitutional. They argue that Trump’s use of IEEPA to justify these tariffs was a legal overreach, pointing out that the Act was designed for national emergencies, not to resolve disputes with allies.

Key Legal Concerns:

- IEEPA Misuse – IEEPA was passed to give the president emergency powers to deal with external threats. Using it for routine trade policy could violate legislative intent.

- Lack of Congressional Approval – Congress traditionally holds the power to regulate foreign commerce under Article I of the Constitution.

- Precedent for Overreach – Allowing this action to stand sets a dangerous precedent for future presidents to bypass democratic oversight.

By pushing for judicial review or legislative action, the WSJ joins a chorus of voices warning against unchecked executive authority.

Economic Fallout: How Tariffs Affect the Average American

Though framed as a strategy to revive American industry, tariffs often translate into higher prices, disrupted supply chains, and job losses. These costs trickle down quickly:

Price Increases:

- Consumers see price hikes on imported goods.

- Domestic producers, facing less competition, often raise prices as well.

- Imported materials cost more, affecting everything from construction to packaging.

Job Market Shifts:

- Some jobs are created in protected industries (e.g., U.S. steel plants).

- But others are lost in sectors reliant on global supply chains or exports.

- Small businesses face increased operational costs, leading to hiring freezes or layoffs.

“Every increase in tariffs is felt by families at the checkout line.” – Economic Policy Professor

Inflationary pressures caused by tariffs, especially in consumer staples and manufactured goods, squeeze household budgets and erode confidence in economic stability.

Media and Legal Advocacy: The Wall Street Journal’s Influence

As one of the most influential economic publications in the world, the WSJ’s editorial board doesn’t take positions lightly. Their advocacy for legal action is about more than policy—it’s about reinforcing the separation of powers.

They highlight that:

- Economic tools should not be politicized or weaponized.

- Legal frameworks must evolve to prevent executive overreach.

- The voice of Congress—representing the people—must be restored in trade decisions.

This media push could pressure lawmakers to reassert their constitutional authority and rebalance the power dynamic in Washington.

Why Congressional Oversight Matters More Than Ever

Allowing presidents to impose unilateral tariffs removes a key democratic safeguard. The WSJ makes a compelling case for requiring Congressional approval, emphasizing the following points:

- Democratic Representation – Legislators are better equipped to assess local economic impacts.

- Preventing Power Consolidation – Prevents a single branch of government from making sweeping economic decisions.

- Market Stability – Predictable policy creates a stable environment for investors and small businesses.

Legislation could soon be introduced to curtail presidential power over trade and strengthen Congressional oversight.

Canada, Mexico, and the Path Forward in International Relations

U.S. relations with Canada and Mexico remain vital to the North American economy. Trade partnerships are built on mutual trust and legal consistency. When tariffs are imposed unilaterally and perceived as unjustified, trust deteriorates.

Implications:

- NAFTA/USMCA Tensions – Tariffs contradict the spirit of these free trade agreements.

- Retaliation Risks – More countries could impose reciprocal tariffs or explore new trading blocs.

- Reduced U.S. Leverage – Damaging long-term partnerships weakens America’s global economic influence.

If future administrations continue Trump-style tariff policies without legal scrutiny, we risk destabilizing the very alliances that fuel our economic engine.

Looking Ahead: The Future of U.S. Trade Policy and Legal Checks

The fallout from Trump’s tariffs and the WSJ’s reaction suggests that the U.S. is at a crossroads in trade policy. Moving forward, legal frameworks and legislative involvement will shape a new path.

Likely Developments:

- Judicial Review of IEEPA Use – Courts may define stricter boundaries for emergency powers.

- New Trade Laws – Congress could reassert authority through legislation regulating executive actions.

- Bipartisan Pressure – Economic unpredictability affects red and blue states alike, encouraging unity on trade oversight.

“We are not just trading goods—we are trading trust, legal precedent, and the rules of global engagement.” – Trade Policy Analyst

Final Thoughts: A Wake-Up Call for Democracy and the Economy

The Wall Street Journal’s editorial isn’t just about tariffs; it’s a wake-up call about governance. It reminds us that policy without oversight can lead to economic harm, strained alliances, and a weakened democracy.

As we reflect on Trump’s trade legacy, we must also consider how future administrations might wield similar powers—and what checks are in place to prevent misuse. Whether you’re a business owner, a voter, or a policy expert, this is a debate worth paying attention to.

Let’s continue to ask tough questions and demand accountability. Because trade doesn’t just move across borders—it moves through the lives of every American.

Trump tariffs, Wall Street Journal, IEEPA, trade war, U.S. trade policy, legal overreach, Canada tariffs, Mexico tariffs, presidential authority, economic impact