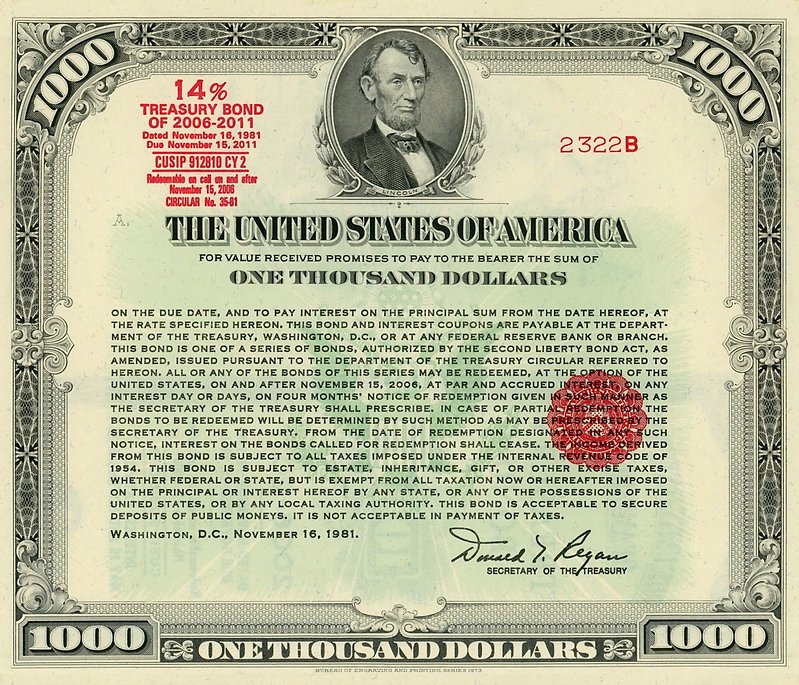

Weak Treasury auction results and rising bond yields reveal deep cracks in U.S. fiscal credibility—threatening both Wall Street and global financial stability.

As 2025 unfolds, global investors face rising uncertainty. From US debt shocks to bond market bedlam, this post unpacks the risks—and rare opportunities—ahead.

As bond markets unravel and nations abandon fiat illusions, the global economy teeters on a cliff. Here’s what you need to know.

Global bond markets are flashing red as liquidity dries up. With central banks silent and banks underwater, the risk of systemic collapse grows.

Japan may liquidate $1.1 trillion in U.S. treasuries, potentially triggering interest rate spikes, recession, and global economic instability.

Stephen Miran’s confusing tariff strategy alarms top bond investors, exposing risks to U.S. markets and consumer prices amid economic uncertainty.