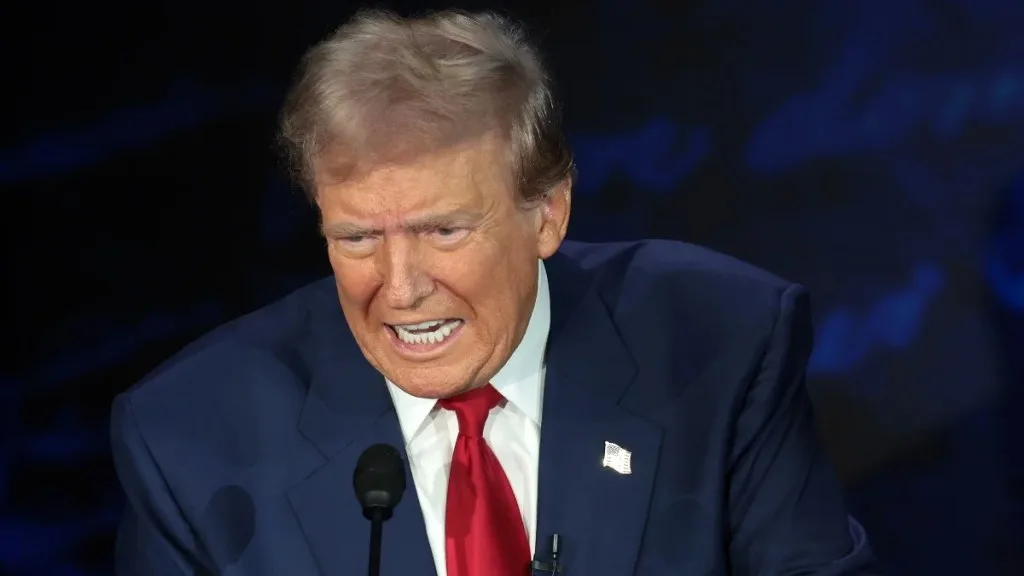

This is How Taco Trump Help Citizens: Ohio removes over 600,000 people from health care plan.

Posted in :

Ohio’s Medicaid disenrollment under Trump-era policy changes left over 600,000 without coverage, revealing deep cracks in the system and the devastating human toll of rushed eligibility reviews.

In the wake of the COVID-era Medicaid expansion, Ohio abruptly rolled back coverage for over half a million residents. This post dives into the unwinding process, why so many lost coverage, how administrative hurdles and policy changes played a part, and what these sweeping disenrollments mean for both Ohioans and the broader national landscape.

You know that feeling when you wake up and realize someone has moved the finish line while you were sleeping? That’s sort of what happened with Medicaid in Ohio. One day, a record 3.4 million Ohioans were enrolled—thanks to pandemic-era rules—next, over 600,000 people are out. I remember chatting with a neighbor who suddenly had to choose between paying for her insulin or rent after she lost her Medicaid coverage. This isn’t just a numbers game. Let’s unravel this mess, one tangled thread at a time.

The Unwinding: Pandemic Protections Fade, Reality Hits Hard

When the COVID pandemic hit, the federal government stepped in with a safety net: the Medicaid continuous enrollment provision. This rule stopped states from kicking anyone off Medicaid, no matter if their income or life situation changed. The result? Medicaid enrollment data in Ohio shows coverage soared from 2.6 million people in February 2020 to a record 3.4 million by March 2023. That’s a jump of nearly 800,000 Ohioans gaining or keeping health insurance during a time of crisis.

But these protections were always meant to be temporary. As the Ohio Department of Medicaid put it:

“The Unwinding process reflects that COVID-era enhanced Medicaid benefits and eligibility were temporary and never meant to be permanent.”

In April 2023, the federal government told states they could start reviewing who still qualified for Medicaid. This kicked off the Medicaid unwinding process—and the numbers dropped fast. By April 2025, Medicaid enrollment dropped to just over 2.8 million in Ohio, according to KFF data. That’s a loss of more than 600,000 people in just two years. For context, between March and October 2023 alone, Ohio Medicaid enrollment dropped by about 259,670.

Even with this big drop, enrollment in April 2025 was still 8% higher than before the pandemic. But the speed and scale of the change was jarring for many families. Ohio’s experience mirrors what’s happened nationwide: as of September 2024, over 25 million Americans have been disenrolled from Medicaid, per KFF and Medicaid.gov.

The COVID pandemic Medicaid coverage expansion helped millions, but the unwinding process has exposed cracks in the system. Some people lost coverage because they no longer qualified, but many others fell through the cracks due to paperwork issues or missed notices. As Timothy McBride, a public health professor, explained, “people were losing coverage not because they were deemed ineligible… but because some breakdown happened in processing the verifications.”

While some Ohioans found new coverage through jobs or the ACA marketplace, many were left uninsured. The Ohio Department of Medicaid says it worked hard to communicate options and help people transition, but the sheer number of disenrollments shows how tough the process was. As Medicaid unwinding continues, the impact on families, hospitals, and communities across Ohio is becoming clear.

Behind the Numbers: The Real Faces of Medicaid Disenrollment

When headlines announce that 600,000 Ohioans lost Medicaid coverage almost overnight, it’s easy to forget that each number represents a real person—a parent, a child, a neighbor. Medicaid disenrollment in Ohio in 2025 isn’t just a statistic; it’s a wave that swept away health security for families across the state, often with little warning.

While the Medicaid eligibility verification process was designed to ensure only those who qualify keep coverage, the reality was messier. According to state data, about three out of four Ohio Medicaid enrollees kept their coverage after renewal (a 74% retention rate as of October 2023). But that means one in four lost it—and not all were truly ineligible. In fact, 28% of those disenrolled were children, and 72% were adults. Many lost insurance because of simple, preventable errors: forms lost in the mail, confusing paperwork, or missed deadlines. These “procedural” issues, as experts like Timothy McBride point out, often had nothing to do with actual eligibility.

Take the story of a single mother in rural Ohio. After receiving a confusing letter, she discovered her children’s Medicaid coverage had vanished. She spent weeks on hold, resubmitting documents, and missing work—all to fix a clerical error. Her experience isn’t unique. Across the state, low-income families, the chronically ill, and rural residents faced similar struggles, highlighting how the Medicaid disenrollment process can hit the most vulnerable the hardest.

Even though the Ohio Department of Medicaid (ODM) worked with community partners to spread the word, communication breakdowns were common. Many families never received notices or couldn’t understand what was required. As a result, some children and adults who should have kept their health insurance lost it instead, joining the growing ranks of uninsured Americans. This loss of coverage means more people skipping doctor visits, relying on emergency rooms, or delaying treatment—outcomes that experts warn will worsen health insurance loss in Ohio and have ripple effects on the entire healthcare system.

“There will be financial difficulties for hospitals and clinics as uncompensated care increases… mortality of adults is likely to rise in the states with large cutbacks in Medicaid coverage.”

– Bruce D. Meyer, University of Chicago

As Medicaid disenrollment in Ohio continues, the real faces behind the numbers remind us that health policy decisions have everyday consequences—especially for those least able to weather the storm.

Policy Dominoes: From Pandemic Protections to Political Pivots

When the COVID-19 pandemic hit, federal rules made it easier for millions to stay covered under Medicaid, pausing the usual eligibility checks. But those pandemic protections were always meant to be temporary. In April 2023, the Medicaid unwinding process began, as required by the Consolidated Appropriations Act of 2023. This forced states like Ohio to quickly review the eligibility of every Medicaid enrollee—over 3.5 million people in Ohio alone.

Ohio’s Medicaid renewal completion rates were among the fastest in the country. The Ohio Department of Medicaid (ODM) proudly stated,

“Ohio performed as one of the top states in the nation to complete the unwinding process – finishing on time and without federal compliance actions or required delays.”

The state wrapped up the process by March 2024, moving back to standard eligibility checks.

But speed came with trade-offs. Rushing through millions of cases meant some people lost coverage not because they were ineligible, but because of administrative hiccups—like missing paperwork or forms lost in the mail. These so-called “procedural terminations” have driven up Medicaid disenrollment rates in Ohio and across the country. As Professor Timothy McBride noted, many states struggled to process verifications seamlessly, leading to eligible people being dropped from the rolls.

Meanwhile, the political landscape is shifting again. President Trump’s budget bill is set to introduce tougher Medicaid eligibility verification processes and new work requirements, while also cutting federal funding for the program. These Medicaid program changes in 2025 could push even more Ohioans off the rolls, especially in rural areas where hospital closures are already a concern.

- Unwinding forced rapid eligibility vetting: Over 600,000 Ohioans lost Medicaid coverage in under two years.

- Administrative speed vs. accuracy: Ohio’s quick compliance meant fewer federal issues, but possibly more mistakes in disenrollment.

- Policy pivots threaten rural care: Shrinking coverage and funding put rural hospitals at risk, compounding the impact on vulnerable communities.

The domino effect is clear: federal policy changes drive state actions, which in turn shape who gets to keep their health coverage. As Medicaid rules tighten and funding shrinks, the risks for Ohio’s uninsured—and its healthcare infrastructure—are only growing.

Patchwork Outcomes: Why Location and Policy Matter (Maybe More Than You Think)

When it comes to the Medicaid unwinding process impact, where you live can make all the difference. As states across the U.S. rolled back pandemic-era Medicaid expansions, the numbers tell a story of sharp contrasts. According to KFF and CMS data, Medicaid disenrollment rates variation is dramatic: North Carolina saw just 12% of enrollees dropped, while Montana’s rate soared to 57%. That’s not just a quirk of population size—it’s a direct result of how each state runs its Medicaid renewal policies.

Why such a wide gap? It often comes down to the nuts and bolts of administration. As public health expert Timothy McBride puts it:

“Generally the variation in these rates depends on a few factors, but mostly relate to how the state administers the program.”

States with more automated systems and user-friendly processes have fewer people falling through the cracks. In places with lots of paperwork or outdated systems, eligible people can lose coverage simply because they miss a form or get stuck in red tape. This “procedural disenrollment” has become a nationwide issue, and it’s not always about income or eligibility—sometimes it’s just about the process itself.

Ohio’s story is a case study in both the strengths and pitfalls of state policy. The state completed its unwinding process faster than most, with the Ohio Department of Medicaid touting its efficiency and strong communication with members. Still, the numbers are staggering: over 600,000 Ohioans were disenrolled between March 2023 and April 2025. That’s a huge drop, but interestingly, Medicaid enrollment in Ohio remains 8% higher than before the pandemic, reflecting both the scale of the COVID-era expansion and the complexity of rolling it back.

Nationally, the Medicaid enrollment national data shows over 25 million Americans have been dropped since the unwinding began, with about 69% retaining coverage. Some of those who lost Medicaid may have found other insurance, but many have not—raising concerns about rising uninsured rates and the impact on health outcomes, especially in rural areas and among vulnerable populations.

Ultimately, the Medicaid expansion states and their individual choices around automation, outreach, and verification methods have shaped a patchwork of results. Ohio’s dashboards and telehealth trends offer policymakers and the public a window into what’s working—and what’s not—as the Medicaid landscape continues to shift.

What’s Next? Navigating a New Normal for Health Coverage in Ohio

As the dust settles from Ohio’s Medicaid unwinding, the state’s health coverage landscape is entering uncharted territory. Even after a sharp Medicaid enrollment decrease—over 600,000 people in just two years—Ohio’s numbers remain about 8% higher than before the pandemic. But the sense of stability that came with expanded coverage is gone, replaced by uncertainty and a patchwork of options that don’t always fill the gaps.

The big question now: As more Ohioans lose Medicaid, will private insurance pick up the slack, or are we headed for a spike in the uninsured? For many, especially in rural and low-income communities, the outlook is worrisome. Losing Medicaid often means tough choices—some may skip doctor visits, rely on emergency rooms for basic care, or simply go without. The Ohio Department of Medicaid insists,

“Efforts were made to ensure a smooth transition… while maintaining access to essential health services.”

But for those caught in the churn, the reality can feel much less certain.

The impact of health insurance loss in Ohio isn’t just personal—it ripples through hospitals, clinics, and the broader economy. As Bruce D. Meyer, a public policy professor, warns, rising uninsured rates can lead to more uncompensated care, financial strain for providers, and even poorer health outcomes for vulnerable Ohioans. Medicaid managed care statistics show that while some may find new coverage through jobs or the ACA marketplace, many are left in limbo, especially if they work part-time or in industries without benefits. One neighbor’s story sums it up: juggling two part-time jobs, she now wonders if health insurance is even within reach.

There are, however, some glimmers of hope. Telehealth, which saw a boom during the pandemic, is still widely used and tracked in Ohio’s Medicaid dashboards. For those in remote areas or with limited transportation, Medicaid telehealth utilization could help bridge some gaps—if coverage and internet access hold up. Managed care plans, too, may offer more flexible options, but they’re not a cure-all. The reality is, even with these tools, coverage gaps are likely to persist.

Looking ahead, Ohio’s health coverage story will depend on policy choices, outreach efforts, and how well private insurance options can adapt. The Medicaid unwinding may be over, but its effects are far from finished. For now, the new normal means more uncertainty—and a health system that must work harder than ever to keep Ohioans covered.

TL;DR: Ohio’s sudden mass Medicaid disenrollment left over 600,000 people scrambling for coverage, revealing cracks in the system and raising pressing questions about policy, communication, and the true cost of cutting off healthcare for vulnerable residents.

OhioMedicaidDisenrollment, MedicaidUnwindingProcess, MedicaidDisenrollmentOhio2025, MedicaidContinuousEnrollment, MedicaidEligibilityVerificationProcess, MedicaidEnrollmentDropped, HealthInsuranceLossOhio, UninsuredAmericansHealthOutcomes, MedicaidProgramChanges2025, COVIDPandemicMedicaidCoverage,OhioMedicaidDisenrollmentCrisis, TrumpHealthcarePolicyImpact, MedicaidUnwindingInOhio, LossOfHealthInsuranceCoverage, RuralHealthcareAccessDecline, MedicaidCoverageLossStatistics, PandemicMedicaidProtectionsEnding, HealthInsuranceLossInOhio, ProceduralMedicaidTerminations, MedicaidRenewalProcessProblems

#OhioMedicaid, #HealthPolicy, #MedicaidUnwinding, #InsuranceTrends, #HealthcareAccess, #MedicaidEnrollment, #CoverageLoss, #PolicyChanges,#OhioMedicaidCuts, #MedicaidUnwinding, #TrumpHealthcarePolicy, #HealthcareLossOhio, #MedicaidDisenrollment, #TacoTrump, #PandemicMedicaidProtections, #HealthcareCoverageLoss, #OhioHealthPolicy, #RuralHealthcareCrisis