Global Economic Outlook: The Surprising Lessons Hidden in Bond Market Chaos

Posted in :

In 2025, global markets are being shaken by US fiscal instability, subprime risks, and crumbling trust in traditional safe havens. With echoes of 2008, a bear market for the dollar, and warning signs flashing across bond markets, investors are rethinking portfolios. What looks like chaos might also be opportunity—if you know where to look.

The unexpected fault lines in global markets, using recent US and Japanese bond market troubles as a lens. By weaving together macroeconomic shifts, policy missteps, personal anecdotes, and market psychology, we’ll unearth hidden patterns that could shape the world economic outlook for 2025 and beyond. From shifting investor strategies to echoes of past crises, readers will gain a sharper, more personal understanding of what the headlines miss—and what they should prepare for next.

As a teenager, I once watched my uncle nearly burn down our kitchen by tossing a still-smoking match into the trash—completely forgetting about the mountain of paper towels beneath. The image pops into my head every time I hear financial experts say “they’re smoking in the dynamite shed” about Washington. Recent events in the US and global bond markets aren’t just numbers. They’re a bonfire of miscalculations, political gamesmanship, and old assumptions going up in smoke. This post will explore what makes 2025 such an odd, unnerving—and yes, opportunity-filled—moment for the world economy, with a few unexpected detours along the way.

A Bonfire of Old Certainties: Why the US Suddenly Looks Like an Emerging Market

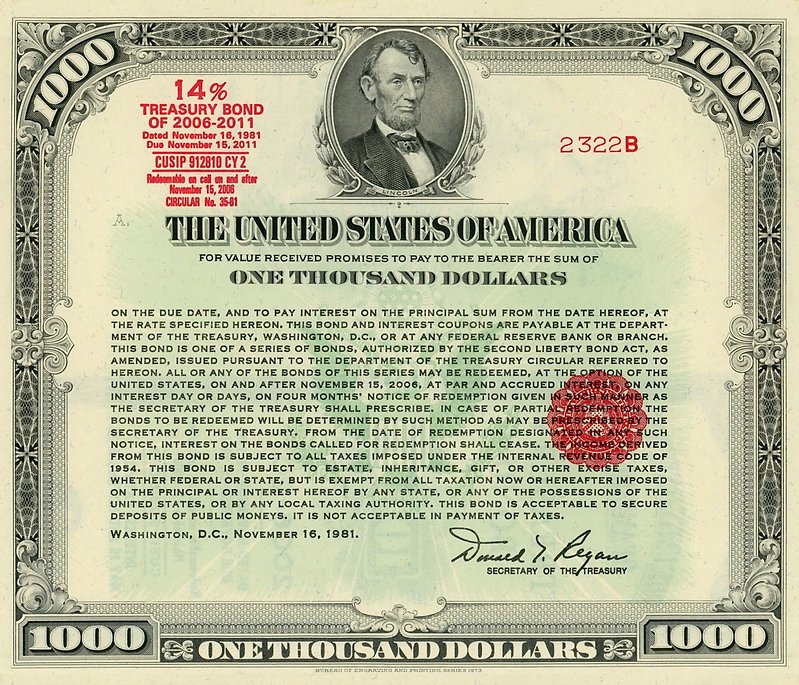

The global economic outlook for 2025 is being shaped by a surprising shift: the United States, long seen as the anchor of financial stability, is now drawing comparisons to emerging markets. This isn’t just a passing observation—it’s a sentiment echoed by global bond investors who are rethinking their exposure to US assets. As one market observer put it, “If you’re a global bond investor, the United States looks a little bit like five or 10% more like an emerging market country, not like the United States of America”.

The turmoil in the US bond market has left investors scrambling for alternatives. In recent months, there’s been a noticeable pivot away from US Treasuries. Instead, portfolios are being rebalanced to include assets like the Australian dollar, Korean won, Bitcoin, and a range of precious metals—gold, silver, platinum, and palladium. The goal? Reduce dollar exposure and sidestep the growing risks tied to US fiscal policy and political unpredictability.

Global Investors Seek Shelter from US Volatility

The shift isn’t just about numbers on a spreadsheet. It’s about trust—trust that has been eroded by a series of shocks. The US posted a staggering $1 trillion deficit in just three months (Q1 fiscal year 2025, October to December). Treasury bond auctions are now yielding over 5%, the highest since 2020. For many, the confidence built up over 30 or 40 years in US economic exceptionalism has started to crack, especially since the much-discussed “Rose Garden incident” earlier this year.

Research shows that this loss of faith is not isolated. The Economic Policy Uncertainty Index hit its highest level in decades in early 2025, reflecting widespread anxiety among investors. Studies indicate that global growth is expected to slow to between 2.3% and 2.9% in 2025, with the US now seen as both a growth leader and a source of global disruption.

Political Crossfire Fuels Fears of a Default Cycle

What’s driving this sudden change in perception? The answer lies in Washington, where both parties have contributed to a sense of chaos. The phrase “smoking in the dynamite shed” captures the mood: fiscal recklessness and political brinkmanship have made the US look less like a safe haven and more like a country teetering on the edge of a default cycle.

Both the Biden and Trump administrations have played a part. Erratic tariff announcements, promises of deficit spending, and inconsistent policy messaging have left global allocators of capital “just shocked”. The result: a scramble to build portfolios that are less exposed to US risks and more diversified across global assets.

- US bond market turmoil: Investors are moving into Aussie dollars, Korean won, Bitcoin, and precious metals.

- Bipartisan uncertainty: Both parties in Congress are amplifying fears of a potential default and eroding market confidence.

- Fiscal policy concerns: Surging deficits and unpredictable trade policies are shaking the foundation of US exceptionalism.

US Exceptionalism Under Scrutiny

The idea that the US could be compared to emerging markets would have been unthinkable just a few years ago. But the numbers—and the mood—tell a different story. The dollar, once the world’s most trusted currency, is now expected to enter a “secular bear market”. While there may be short-term rallies, the long-term trend points lower, as global investors look elsewhere for stability and growth.

This is not just a cyclical blip. As one analyst noted, the question is whether this is a cyclical or secular change. The answer seems clear: “This is a secular bear market for the dollar”. The implications for the global economic outlook and fiscal policy are profound. With the US no longer seen as the unshakeable pillar of the global financial system, investors are recalibrating their strategies, and the world is watching closely.

“If you’re a global bond investor, the United States looks a little bit like five or 10% more like an emerging market country, not like the United States of America.”

The bonfire of old certainties has left the global economic outlook for 2025 clouded by uncertainty. As the US grapples with the consequences of its fiscal and political choices, the world’s investors are hedging their bets, and the age of unquestioned US exceptionalism may be coming to an end.

Echoes of 2008 and the Ghosts in the Data: Are Red Flags Being Ignored?

As the World Economic Outlook darkens, a sense of déjà vu is creeping into financial circles. Market insiders, many of whom witnessed the 2008 financial crisis firsthand, are now raising concerns about familiar warning signs. The parallels are hard to ignore. In the run-up to the last crisis, few anticipated the scale of the financial turbulence that would soon engulf the globe. Today, the data is once again sending mixed signals, and the ghosts of 2008 seem to be stirring.

During the 2008 financial crisis, experts like those who advised the Financial Crisis Inquiry Commission were at the epicenter of the storm. Their experience offers a critical lens for interpreting today’s market volatility and policy uncertainty. The question now is whether the financial system is heading down a similar path, and if so, are the red flags being ignored?

Subprime Risk: The Return of an Old Foe

One of the most striking similarities to the pre-2008 era is the rise in subprime risk. This time, the danger is not confined to traditional mortgage markets. Instead, it’s spreading through consumer credit channels—especially “buy now, pay later” services and alternative lenders like Affirm and Upstart. Tertiary lenders, such as Synchrony and Credit Acceptance, are also underperforming compared to major financial institutions. The underperformance is dramatic, and the trend is unmistakable: subprime credit risk is rising, though not yet at crisis levels.

Research shows that financial system vulnerability is increasing, particularly in these alternative lending sectors. The pattern is eerily reminiscent of the early warning signs that preceded the last crash. While the scale may differ, the underlying dynamics—easy credit, rapid expansion, and mounting defaults—are all too familiar.

Policy Whiplash and Unintended Consequences

Another key factor fueling market volatility is the abrupt shift in policy regimes. The transition from progressive to conservative administrations, such as the shift from Biden to Trump, has triggered sudden changes in financial regulations and student loan policies. These policy swings can have jaw-dropping, unintended consequences, especially when millions are moved off “gravy train” credit arrangements and forced to adjust quickly.

Studies indicate that such policy uncertainty is a major driver of global financial turbulence. The Economic Policy Uncertainty Index reached its highest level this century in early 2025, reflecting the anxiety gripping investors and policymakers alike. The rapid changes in student loan policy, for example, have left many borrowers exposed, echoing the abrupt shocks that destabilized markets in 2007 and 2008.

Mentors, Market Signals, and the Power of Patterns

Veteran market observers emphasize the importance of listening to “mentors”—trusted voices across different markets and continents. As one expert put it:

“When three or four or five or maybe six people say the same thing to me in roughly the same week and they’re in three or four different continents… it really makes the hair on the back of my neck go up.”

This synchronization of global expert warnings should not be dismissed as coincidence. In recent months, multiple insiders have reported seeing the same troubling patterns in subprime lending, student loans, and policy shifts. These signals, coming from diverse corners of the financial world, suggest that systemic issues may be brewing beneath the surface.

Since publishing a book on the Lehman collapse, the author has delivered 140 speeches in 16 countries, underscoring the global appetite for shared market wisdom. The lesson? Patterns and signals matter more than any single indicator. Increasingly, markets are experiencing “triple threat” days—where stocks, bonds, and the dollar all fall together—a rare and worrying sign of systemic stress.

Bond Market Chaos and the Debt Dilemma

Recent developments in the bond market have only heightened concerns. A weak auction for US Treasury bonds led to rising yields and renewed investor anxiety about the nation’s debt load. This episode underscores the fragility of the current financial environment, where even minor shocks can trigger outsized reactions.

As the World Economic Outlook points to slowing global growth and persistent inflation, the risks of policy missteps and market volatility are mounting. The lessons of 2008 remain as relevant as ever: when multiple warning signs converge, it’s time to pay attention. The ghosts in the data are speaking—are we listening?

Bond Market Bedlam: When Safe Havens Aren’t So Safe Anymore

For decades, the bond market has been the bedrock of financial stability—a reliable safe haven for investors during times of economic uncertainty. But recent events have turned this long-standing assumption on its head. Weak demand for both US and Japanese bonds is now signaling a seismic shift away from traditional safe havens, raising urgent questions about the future of global finance and the strategies investors must adopt to navigate growing market volatility.

The cracks in the foundation became impossible to ignore in 2022, when a series of shocks rattled advanced economies. As the 10-year US Treasury yield spiked and Japan’s bond auctions suffered from tepid demand, it became clear that this was not an isolated US phenomenon. Instead, a global trend was emerging—one where even the most trusted government bonds could no longer guarantee safety or portfolio rescue in times of crisis.

Geopolitical risks, from ongoing conflicts to unpredictable fiscal policies, have only intensified the turbulence. The world’s largest bond market, the $29 trillion US Treasury market, is now facing growing concerns about its ability to attract buyers. As one observer put it, “If you’re a global bond investor, the United States looks a little bit like five or 10% more like an emerging market country, not like the United States of America.” This bipartisan uncertainty in Washington—marked by wild swings in deficit spending, tax policy, and rate cuts—has left global allocators scrambling to rebalance portfolios and reduce dollar exposure.

The consequences of this financial turbulence extend far beyond Wall Street. Bond market volatility is now impacting mortgages, car loans, and the daily economic realities of households around the world. In the past, investors could count on bonds to offset stock market losses. But since 2022, the old playbook has failed. Stocks and bonds have been dropping together with alarming frequency, upending decades-old diversification strategies and forcing global pension funds and allocators to rethink their approach.

Research shows that the global growth slowdown is compounding these challenges. Forecasts for 2025 suggest growth will decelerate to between 2.3% and 2.9%, a pace that edges dangerously close to recessionary territory. Inflation, while expected to decline, remains stubbornly above pre-pandemic levels, and monetary policy across advanced economies is becoming increasingly desynchronized. The US, once seen as a growth leader, is now viewed by some as a disruptor, with its policy decisions sending shockwaves through global markets and emerging economies alike.

Trade policy shocks, persistent uncertainty, and the rise of protectionism are further fueling market volatility. The Economic Policy Uncertainty Index reached its highest levels this century in early 2025, a stark indicator of the anxiety gripping investors. As one market veteran noted, “For the last 30 years… if there was any type of crisis… your bonds might have made 10, 20, 30%. What’s happened since 2022… is really blood-curdling because it keeps happening.”

The situation in Japan underscores the global nature of this bond market bedlam. Once the world’s “yield anchor,” Japan is now grappling with its own weak bond auctions and fiscal challenges. This is not just a US story; it’s a worldwide phenomenon that is forcing a fundamental rethink of risk, safety, and the psychology of investing.

What does this mean for the average person? Simply put, the days when bonds could be counted on to cushion the blow of a stock market downturn are over—at least for now. The instability in the bond market is affecting everything from the cost of a home loan to the security of retirement savings. Financial market psychology, often overlooked, has become a key driver in this new era of uncertainty.

As global allocators and pension funds adjust to this reality, the lessons are clear: new strategies are needed to weather the storm. The old rules no longer apply. In a world marked by financial turbulence, global growth slowdown, and persistent market volatility, investors and policymakers alike must adapt to a landscape where safe havens aren’t so safe anymore.

TL;DR: 2025’s global economic outlook is marked by growth slowdown, policy confusion, and widespread market anxiety. Unpredictable bond market behavior, political flip-flops, and echoes of past crises signal that investors should expect turbulence—and prepare with diversified strategies beyond the US dollar.

GlobalEconomicOutlook, EconomicOutlook2025, WorldEconomicOutlook, GlobalGrowthSlowdown, TradeAndDevelopment, PolicyUncertainty, FinancialTurbulence, EmergingMarkets, Inflation, MonetaryPolicy,globaleconomy2025, bondmarket, USdollar, investorconfidence, fiscalpolicyrisk, inflation, debtcrisis, subprimelending, studentloanshock, BRICSchallenge, treasuryyields, marketvolatility

#GlobalEconomy, #BondMarket, #EconomicTrends, #InflationRisk, #EmergingMarkets, #PolicyShifts, #FiscalPolicy, #TradeDevelopment,#GlobalEconomy, #BondMarket, #USDebt, #FinancialCrisis, #FiscalPolicy, #SubprimeRisk, #2025Forecast, #BRICS, #Inflation, #InvestorAnxiety