Explore the Mar-a-Lago Accord, Trump’s ambitious plan to devalue the dollar and disrupt global finance. Uncover the risks, benefit theories, and real-world consequences with expert insights and relatable examples.

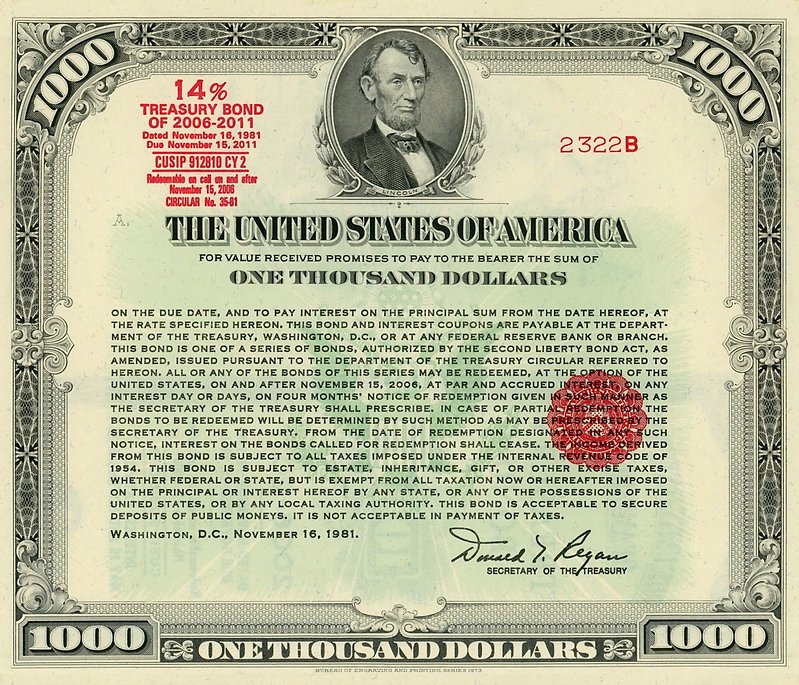

As 2025 unfolds, global investors face rising uncertainty. From US debt shocks to bond market bedlam, this post unpacks the risks—and rare opportunities—ahead.

Global credit markets may look stable, but cracks are forming beneath the surface—especially for consumers, small banks, and vulnerable borrowers.

As bond markets unravel and nations abandon fiat illusions, the global economy teeters on a cliff. Here’s what you need to know.

China isn’t ditching the dollar overnight—but it is playing a long, strategic game with the yuan. Here’s how it may reshape global currency power.

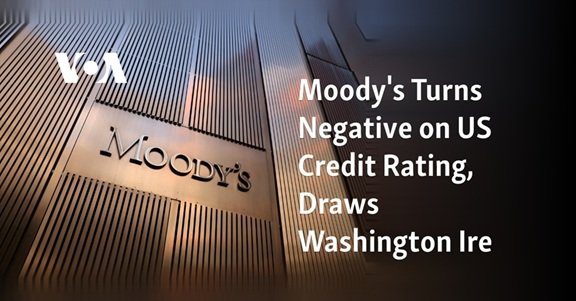

Moody’s stripped the U.S. of its perfect credit rating—highlighting growing debt, political gridlock, and fading global confidence in America’s economy.